When we first step into the world of trading with technical analysis, backtesting often seems like that magic tool promising answers to all our burning questions: “Will this strategy really work?” or “Would I have made money if I’d used this before?” We start testing indicators found on YouTube, patterns read in books, and ideas seen in forums. From these trials, thoughts begin to creep in: “If I had bought here when everything dropped and sold here when everything surged, I’d be sipping a mojito on the beach, trading from my phone right now.” And that’s when we start to lose our minds, frantically trying out strategies and chasing profits to quit that job we despise.

At that point, the obsession sets in: we backtest every strategy we can get our hands on, change parameters, tweak a rule, add filters… all in the hope of finding that secret formula for long-sought financial freedom. We desperately want to escape a reality that has us working 8 hours a day, and backtesting seems to be the solution, the most direct path to achieving our dreams.

But amidst all the candles and indicators, and seeing our initial capital grow with many winning trades, something is still escaping us. Are we truly validating a solid strategy, or just building castles in the air? Because, logically, the real market isn’t a chart we can pause and rewind; in live trading, losses are real.

But before you dive headfirst into backtesting, it’s worth asking yourself a crucial question (one that could completely change how you view this tool):

Does backtesting genuinely help you win… or is it merely building mirages?

Let’s shed some light on this question in this article and better understand what backtesting truly is.

Contenido

What is Backtesting?

In essence, you could say it’s applying your strategy backward in time (entry signals, stop-loss, take-profit, etc.) to past data using a specific asset. That is, you take data from, for example, the last month with 1-hour candles and see if your strategy performed well or poorly during that period. If you want a more mathematical explanation, Wikipedia has a good one.

This allows us to answer several questions:

- Would my strategy have performed well during this period?

- Do I have a high success rate?

- How much would I have lost during the worst periods?

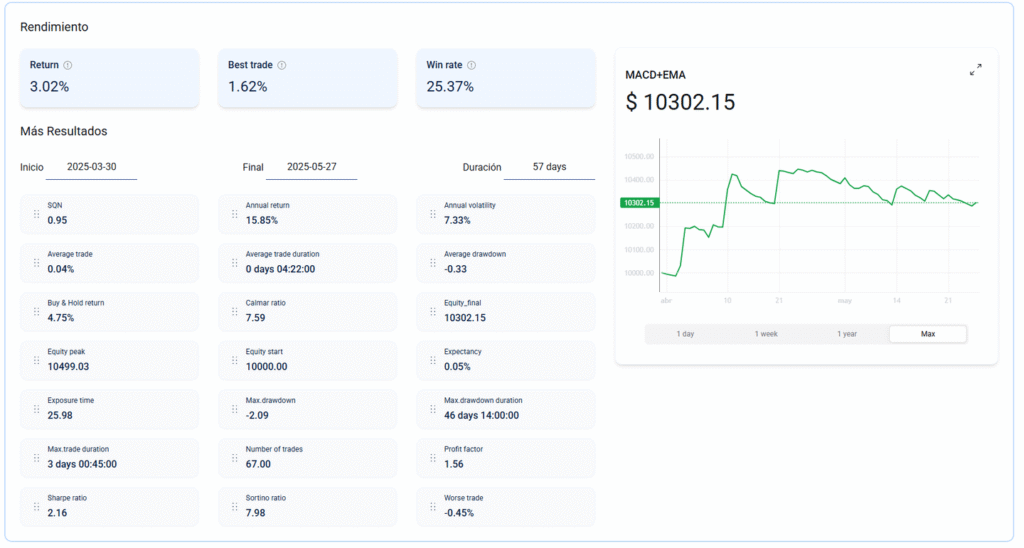

All of this can be perfectly visualized by running this tool. For instance, in BlueCandle, you can see interactive charts showing exactly when you would have entered and how you would have closed your trades, along with key metrics on their historical performance. This gives you a perfect idea of how your trades would have fared.

In backtests, no strange algorithms, artificial intelligence, or anything beyond your own strategy is used. You simply look at the chart, execute the rules you’ve defined, and analyze the results.

Advantages of Backtesting

The advantages that backtesting offers are several and quite beneficial:

It Tells You If Your Strategy Works or Is Pure Smoke

There’s nothing worse than starting to trade without having tested an idea or strategy that you’ve seen and sounds good. A well-conducted backtest will give you a clear hint if your strategy works correctly across different market phases.

It Boosts Your Confidence

When you’ve reviewed 200 past trades during various market conditions and your strategy has performed well with positive results, live trading becomes much more natural and less emotional (especially if it’s algorithmic trading).

It Improves Your Risk Management

When you perform a backtest and see what happens during losing streaks, how much you lose on average, and what your largest drawdown (peak loss) is, you can adjust your positions or strategy according to the risk you observe in the backtest.

Dangers of Backtesting

We’ve seen that the advantages seem very good, but it’s important to consider that there are also risks:

Future Sight Bias (Looking at the Chart with Foresight)

Having the chart in front of you and knowing the future of each candle can lead us to create false confidence. It seems like you exited at the exact peak, but in reality, the peak isn’t visible, and the moment might not be so clear, causing you to make mistakes when closing trades prematurely.

Ignoring Commissions or Spreads

Especially if we are scalping or day trading, commissions can make a strategy that seemed profitable and performed very well in the backtest actually wipe out your account because you lose on every trade.

Customizing Strategies (Overfitting)

This is similar to what is known as overfitting in artificial intelligence. That is, you see why the strategy failed, you modify it, you test it again, you modify it again, and so on, over and over, until it seems to work perfectly. In reality, what you’re doing is adjusting it only for that specific asset and historical period, and if you test it on another asset or another period, it might fail. In other words, you were creating the illusion that it works.

Testing Only in Favorable Conditions

If you’re testing strategies and the market is trending upwards, it’s likely your strategy will also perform very well. The danger comes when a sideways market appears where the rules of the game change, and this can lead to a big surprise if we are not prepared.

So… Does It Work or Not?

Yes, backtesting works, and it’s a very powerful tool, but it must be done intelligently and honestly with ourselves. It’s not about finding the strategy that gives us a perfect profit curve (I can tell you that doesn’t exist or is extremely difficult), but about validating ideas, understanding the risks and how to avoid them as much as possible, and trying to avoid errors whenever feasible.

To summarize, backtesting won’t tell you how your strategy will perform in the future—nobody knows that. But it canprepare you to face the future from the security of having a well-thought-out strategy.

Tips for Effective Backtesting

Here are some tips for conducting good backtests:

- Define your rules in advance, thoughtfully and clearly, and don’t modify them a posteriori to “improve the backtest” by changing parameters if you don’t fully understand what you’re doing.

- Test with various assets and different periods (trends, sideways markets, low and high volatility). A strategy that only yields good results for the last year on EUR/USD is not a solid strategy.

- Simulate real market conditions. Use the commissions your broker charges to adjust for the actual conditions you’ll be trading under.

- Test it on a demo account before going live. Observe how it behaves in real time: latency, execution errors, unexpected signals, etc. Transitioning to real data in a live market always reveals some flaws.

- Evaluate key metrics and don’t just look at profit. Pay attention to the maximum drawdown, the ratio between winning and losing trades, various ratios, and the system’s stability against small parameter changes. Not everything that makes money on paper is tradable (or at least it can prevent nasty surprises).

Conclusion

It’s clear that a well-executed backtest is one of the fundamental pillars of technical analysis. It helps you transition from strategies you’ve seen or believe might work well, to solid ones proven in environments similar to what you’ll encounter in the future. It might not guarantee that you’ll earn a lot in the future, but it will help you discard ideas, understand the risks of your operations, and trade with the confidence that you’re basing decisions on data, not assumptions.

However, as we’ve seen, you must be very careful not to force results. Running too many backtests on the same timeframe and asset can only lead to problems and make you believe you’re achieving something that won’t actually materialize. Don’t look for an infallible system that will always win; look for one that works well under any circumstance and that you can execute without hesitation.

In summary: Backtesting is not a guarantee of success, but it is a very solid foundation upon which to build a profitable system… provided you use it with good judgment, discipline, and a realistic mindset.

And you? Have you tried backtesting your strategies? Head over to BlueCandle and enjoy your free backtests.

No Comments