When you’re starting out in trading with technical analysis, the Simple Moving Average in trading (also known as SMA) is one of the first indicators you should master. Not only is it one of the easiest to understand, but it’s also one of the most powerful tools for identifying trends, dynamic support, and resistance levels.

Many traders use it in their day-to-day trading — and I’m not talking about beginners, but experienced traders who instantly spot a trend change the moment price crosses their favorite moving average.

You’ve probably felt a bit lost at times when looking at a chart. Well, the SMA can help smooth out the market noise and let you focus on the true direction of the price. So, let’s get right into it and discover how it works.

Contenido

History of the SMA

In all our posts we try to include a bit of history, mentioning who discovered the indicator and how. But in this case, since it’s such a simple concept, there’s no clear inventor. Moving averages have been used in technical analysis for decades — even before computers existed.

It was in the 60s and 70s when traders and institutional investors began noticing how SMAs helped filter out erratic market movements and spot real trends.

As we’ve mentioned, to this day they remain a key component of technical analysis, used by traders of all levels, from beginners to seasoned professionals.

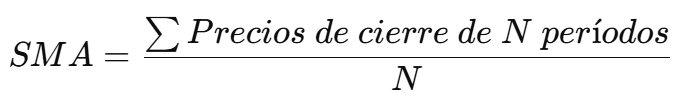

How to calculate the SMA

The calculation of the Simple moving average in trading is one of the simplest in technical analysis:

Where N is the number of periods you want to average.

For example, a 10-period SMA takes the closing prices of the last 10 days and calculates the average. Each time a new data point is added, the oldest one is removed, always keeping the average of the last 10 values.

Here’s an example of a 5-period SMA:

If the closing prices were 10, 12, 14, 13, 15, then the SMA would be:

Reading the SMA indicator

Think of the Simple moving average in trading as a trend indicator. Its main purpose is to show the general direction of the market.

How to interpret the SMA

Interpreting this moving average is quite straightforward:

- If the price is above the SMA, the trend is bullish.

- If the price is below the SMA, the trend is bearish.

Types of SMAs based on period length

Not all SMAs are the same. Depending on the number of periods you use, their purpose will vary.

- Short-term SMA (5–20 periods): Great for spotting quick trend changes.

- Medium-term SMA (50 periods): Shows mid-term trends, widely used for swing trading.

- Long-term SMA (100–200 periods): Used to confirm long-term trends.

Trading signals with the SMA

SMAs can generate several useful signals for trading:

Price crossing the SMA

This is a classic method many traders rely on to determine market direction — and to place trades:

- Buy when the price crosses above a key SMA (e.g., SMA 50).

- Sell when the price crosses below a key SMA.

Many traders don’t use it as a signal on its own but still check if the price is above or below a moving average before entering a trade.

Example: If the price was below the SMA 50 and now crosses above it, that could be a buy signal.

Moving Average Crossovers (Golden Cross & Death Cross)

One of the most popular signals:

- Golden Cross: Occurs when a short SMA (50) crosses above a long SMA (200). Indicates a strong bullish trend.

- Death Cross: Occurs when a short SMA (50) crosses below a long SMA (200). Indicates a strong bearish trend.

Example: If the SMA 50 crosses above the SMA 200, that’s a buy signal.

The SMA as a dynamic support or resistance

The SMA can act as a dynamic line of support or resistance for price:

- In uptrends, price bounces off the SMA before continuing higher.

- In downtrends, price bounces off the SMA before continuing lower.

Example: If the price drops and touches the SMA 50 but then bounces upward, it could signal a buying opportunity.

Combining with other indicators

SMAs become even more effective when combined with other indicators:

SMA + RSI

- Buy: RSI crosses above 50 and price is above the SMA.

- Sell: RSI crosses below 50 and price is below the SMA.

SMA + MACD

- Trend confirmation: MACD is positive and price is above the SMA.

- Bearish confirmation: MACD is negative and price is below the SMA.

SMA + Bollinger Bands

- If price bounces off the lower band and is near the SMA, it may be a buy signal.

- If price touches the upper band and drops below the SMA, it may be a sell signal.

Simple SMA Strategy in BlueCandle

Let’s see how to create a strategy using three SMAs in BlueCandle to visually identify trends.

Required indicators

- SMA 4

- SMA 9

- SMA 18

Entry rules

- Buy: When SMA 10 crosses above SMA 50.

In BlueCandle you can easily set this up using the visual strategy builder:

Exit rules

-

Close the trade when the opposite SMA crossover occurs.

Backtesting

We tested this strategy in BlueCandle on a trending asset to see how it performs:

As we can see, the results show that this strategy can be quite effective in clearly trending markets.

Why does it work?

This strategy follows the trend instead of trying to anticipate it, allowing you to capture the strongest moves while avoiding sideways markets.

Conclusion

Now you can see why the SMA is one of the most widely used indicators in the trading world — thanks to its ease of use and effectiveness. It’s great for spotting trends, finding entry and exit points, and even acting as support or resistance.

If you’re not using it yet, it’s time to start and unlock its full potential. Trust me — you won’t regret it.