Sometimes when we talk about automated trading, many people think of a robo-advisor—one of those tools that promises to simplify your investment decisions, helping you take fewer risks and making everything easier.

In reality, it’s a different approach from the one we take here at BlueCandle. Both our platform and robo-advisors use advanced technology, but they serve very different purposes.

In this article, we’ll look at what each one offers, their advantages and disadvantages, and why you might prefer using BlueCandle over a traditional robo-advisor.

But as I always say, let’s get to the point.

Contenido

What is a Robo-Advisor?

A robo-advisor is essentially a digital financial advisor. In other words, imagine you want to invest and your first thought is to go to the bank and speak with the manager assigned to you. They will ask you a few questions, such as:

- How much do you want to invest?

- For how long?

- How do you feel about risking that money?

- etc.

Based on these questions, the manager will get an idea of your investor profile and design a personalized portfolio for you.

So, when you enter the robo-advisor platform, you’re given a short test to determine your investor profile.

- How much money do you want to invest?

- For how long?

- How comfortable are you with seeing your money go up and down?

Based on those questions, the system will create an automated portfolio for you, typically made up of index funds or ETFs (which are like “packages” of stocks or bonds). This ensures your money is diversified, well-distributed, and well-balanced according to your profile.

Once the robo-advisor is set up, it begins to monitor your portfolio continuously and makes automatic adjustments (for example, if an asset goes up a lot and throws your portfolio out of balance, it rebalances it to lock in gains). In other words, if you don’t want to learn about trading, technical analysis, or making decisions, this is the tool for you.

Pros and Cons of a Robo-Advisor

Let’s do a quick summary of the pros and cons of this investment tool.

Pros

- Simplicity: As we’ve said, it’s an ideal tool for anyone who doesn’t want to complicate things; you just answer a few questions and that’s it.

- Automatic Diversification: It builds balanced portfolios that aim to minimize systematic risks.

- Low Costs and Efficiency: With no human managers involved, the costs are usually much lower than with traditional funds.

Cons

- Limited Customization: Your decisions are limited by the platform.

- Inability to Adapt Quickly: If the market suddenly changes, your robo-advisor barely reacts until the next rebalancing, which can be quite late.

- Long-Term Focus: It’s typically not suitable for active traders or those looking to intervene in the short or medium term.

Differences Between BlueCandle and a Robo-Advisor

The most significant differences are as follows:

- Purpose: While the robo-advisor focuses on maintaining and managing portfolios for people who don’t want to know about trading, BlueCandle is designed for traders who want to execute strategies, perform analysis, and automate them.

- Flexibility and Control: BlueCandle allows you to monitor bots, see their performance in real time, adjust parameters, and design your own strategies. Here, you are the one who decides what to trade, when, and how.

- Technique and Adaptability: A robo-advisor follows fixed rules, whereas BlueCandle provides many possibilities for adaptation: the algorithm, the timing, the assets, etc. Everything is in your hands, but with real-time data.

- Users: Robo-advisors attract the passive investor, while BlueCandle is designed for active traders who want to invest, test, learn, and gain control over their operations.

When to Use BlueCandle Instead of a Robo-Advisor

If you’re reading this, it’s likely because you’ve already taken your first steps into the world of investing or you’ve been searching for a way to trade all day without being glued to your screen. And maybe you’ve heard about robo-advisors, but something tells you that’s not all you need.

So, I’m going to give you a short guide to help you decide, in a clear and honest way, when you should use BlueCandle.

If You Don’t Want to Be Passive and You Want to Be in Control

A robo-advisor is made for you to set it up and forget about it. You configure it on the first day, and the system does everything without you being able (or needing) to intervene.

But if you want to understand what you’re doing, adjust your strategies, choose when to enter and exit, and, most importantly, be in control of your trading, then BlueCandle is for you.

If You Want to React Quickly When the Market Changes

We already know that the market doesn’t wait. Robo-advisors are designed to work for the long term and make adjustments every so often. In contrast, with BlueCandle, you can act in real time, automate decisions, test new trading ideas, and adapt the exact moment the market requires it.

If You’re Interested in Learning, Testing, and Improving

BlueCandle is by no means a black box. On BlueCandle, you can:

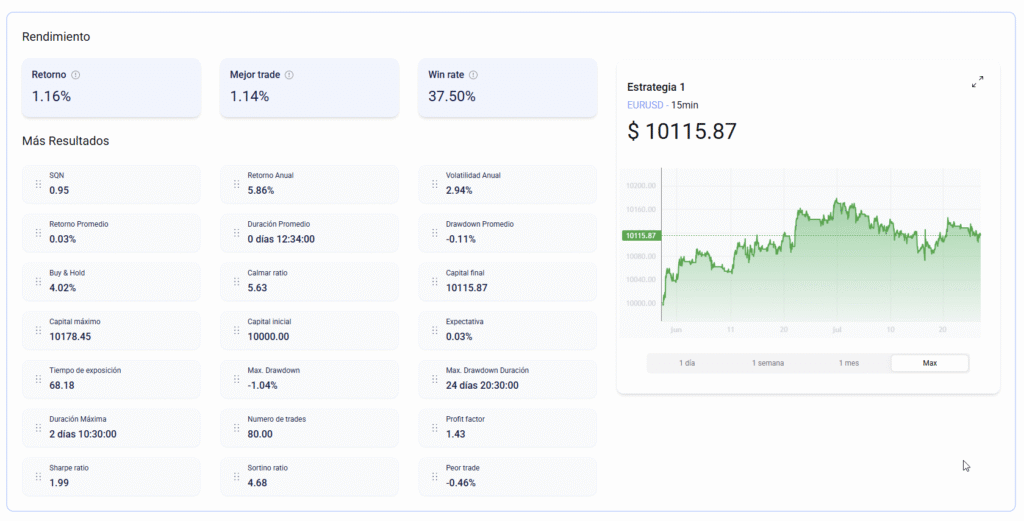

- See how each strategy works (because the strategies are yours).

- Do backtests with historical data until you find the perfect algorithm.

- Analyze the results of your bots.

- Experiment with the configurations of each indicator.

You don’t need to be an expert at all, but you do need to have curiosity. BlueCandle is like a laboratory where you decide what to test and the system helps you do it without complications.

If You’re Interested in Scaling Results Without Complicating Things

With BlueCandle, you can have several automated strategies running in parallel, test different approaches, all from a simple, visual interface designed for the user. You don’t need to program, you just need an idea, and BlueCandle helps you put it into practice.

Conclusion

As we’ve seen, if what you’re looking for is a simple, automated, and passive solution, a robo-advisor will meet your expectations, and you don’t need to complicate things further. Many people don’t want to be a Wall Street trader; they just want to get some return from the money they have.

But if what you’re looking for is to be a trader: to design, test, and adjust strategies and react in real time with advanced tools, BlueCandle is your platform. I assure you that you’ll greatly enjoy our platform, and it will be your right hand in your day-to-day trading.

With BlueCandle, you won’t give up your freedom; you’ll enhance it. Because a truly powerful tool is one that lets you decide, learn, and grow, without hiding how it works on the inside.

No Comments